Carbon Credit Efforts Is To Mitigate Climate Change And Reduce Greenhouse Gas (GHG) Emissions

|

| Carbon Credit |

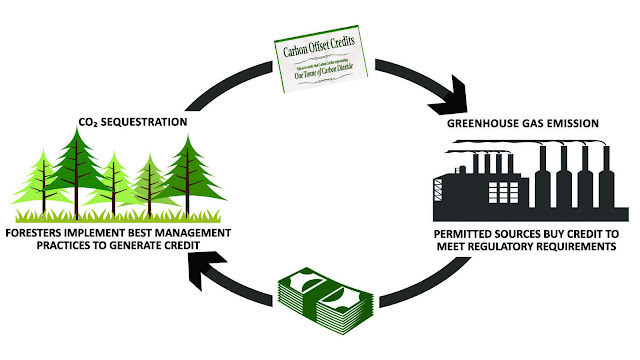

Carbon

Credit is a crucial component of global efforts to mitigate climate

change and reduce greenhouse gas (GHG) emissions. They are a mechanism that

incentivizes organizations and individuals to reduce their carbon dioxide (CO2)

and other GHG emissions by providing financial rewards for emissions

reductions. The underlying principle of carbon credits is based on

the concept of carbon offsetting. It recognizes that emissions reductions can

be achieved by either reducing emissions at the source or by investing in

projects that reduce emissions elsewhere. Carbon credits represent a unit of

measurement that quantifies the reduction, avoidance, or removal of one metric

ton of CO2 or its equivalent in other GHG emissions. These credits are tradable

and can be bought and sold.

The process of Carbon

Credit trading begins with the establishment of a baseline emission

level for a particular entity or project. In order to quantify emissions

reductions, this baseline acts as a standard. If the entity or project achieves

emissions reductions beyond the baseline, it is eligible to receive carbon

credits. These credits can then be sold to other organizations or individuals

that have not met their emission reduction targets. The

projects that generate carbon credits can take various forms. For example,

renewable energy projects such as wind farms or solar power plants can generate

credits by displacing electricity generated from fossil fuels. Energy

efficiency projects that reduce energy consumption and thus emissions also

qualify for credits. Additionally, projects focused on reforestation and

afforestation, which absorb CO2 through the growth of trees and vegetation, can

generate carbon credits.

According

To Coherent Market Insights The Carbon Credit Market Was Worth US$ 25,345.8

Million In 2022, With A Compound Annual Growth Rate (CAGR) Of 24.4% From 2023

To 2030.

The value of Carbon

Credit is determined by demand and supply dynamics. Governments and

international bodies often regulate and oversee carbon to ensure their

transparency and integrity. Participants include companies, governments, and

individuals who either buy or sell carbon credits. Buyers may include companies

seeking to meet their emission reduction targets or investors looking for

sustainable and environmentally responsible investment opportunities. The

significance of carbon credits lies in their ability to provide financial incentives

for emission reductions.

By assigning a monetary value to carbon

emissions, they create economic incentives for organizations to invest in

cleaner technologies, renewable energy, and sustainable practices. This

approach encourages innovation and the adoption of low-carbon technologies,

ultimately accelerating the transition to a more sustainable and low-carbon

economy. Moreover, carbon credits contribute to international

efforts to combat climate change. They provide a mechanism for developed countries

to support emissions reductions in developing nations through financial

investments in Carbon Credit projects.

For

More Details On Carbon Credit Visit: Https://Www.Globenewswire.Com/En/News-Release/2021/07/01/2256485/0/En/Global-Carbon-Credit-Market-Is-Estimated-To-Account-For-US-2-407-8-Mn-By-End-Of-2027-Owing-To-Increasing-Global-Warming-Impact-Says-Coherent-Market-Insights-CMI.Html

You

Can Also Read Press Release: Https://Www.Coherentmarketinsights.Com/Press-Release/Carbon-Credit-Market-3727

Comments

Post a Comment